Recent research by CDSB and WBCSD has found 40 ESG issues key to corporate sustainability, including 10 emergent issues. Here we present the findings of the research and offer helpful tips to companies on how they can better report against them.

Companies around the world are increasingly communicating with their shareholders, investors and other stakeholders about significant environmental, social and governance (ESG) issues. Key to this trend is the growing understanding of the risks these issues pose to economic, environmental and social systems. Working groups and task forces have assembled, guidance has been drafted, and reporting requirements issued – efforts which have expanded and reconfigured the corporate reporting landscape.

Like all transformations, though, there has been a concurrent dose of turbulence. This has been especially felt by report preparers, with some feeling confused by the many different but overlapping requirements, standards and guides.

With that in mind, the Climate Disclosure Standards Board (CDSB) and the World Business Council for Sustainable Development (WBCSD) set out to map and comprehend the ESG reporting landscape for the benefit of report preparers and users. To do so, we analysed over 1000 reporting requirements from the Reporting Exchange, more than 1000 indicators issued by standard setters collected on the Indicator Library, and around 2500 material issues reported by close to 150 large, international companies to Reporting matters. As a result, were able to better understand which ESG issues are most important to corporate sustainability and highlight emergent issues for standards setters to consider moving forward.

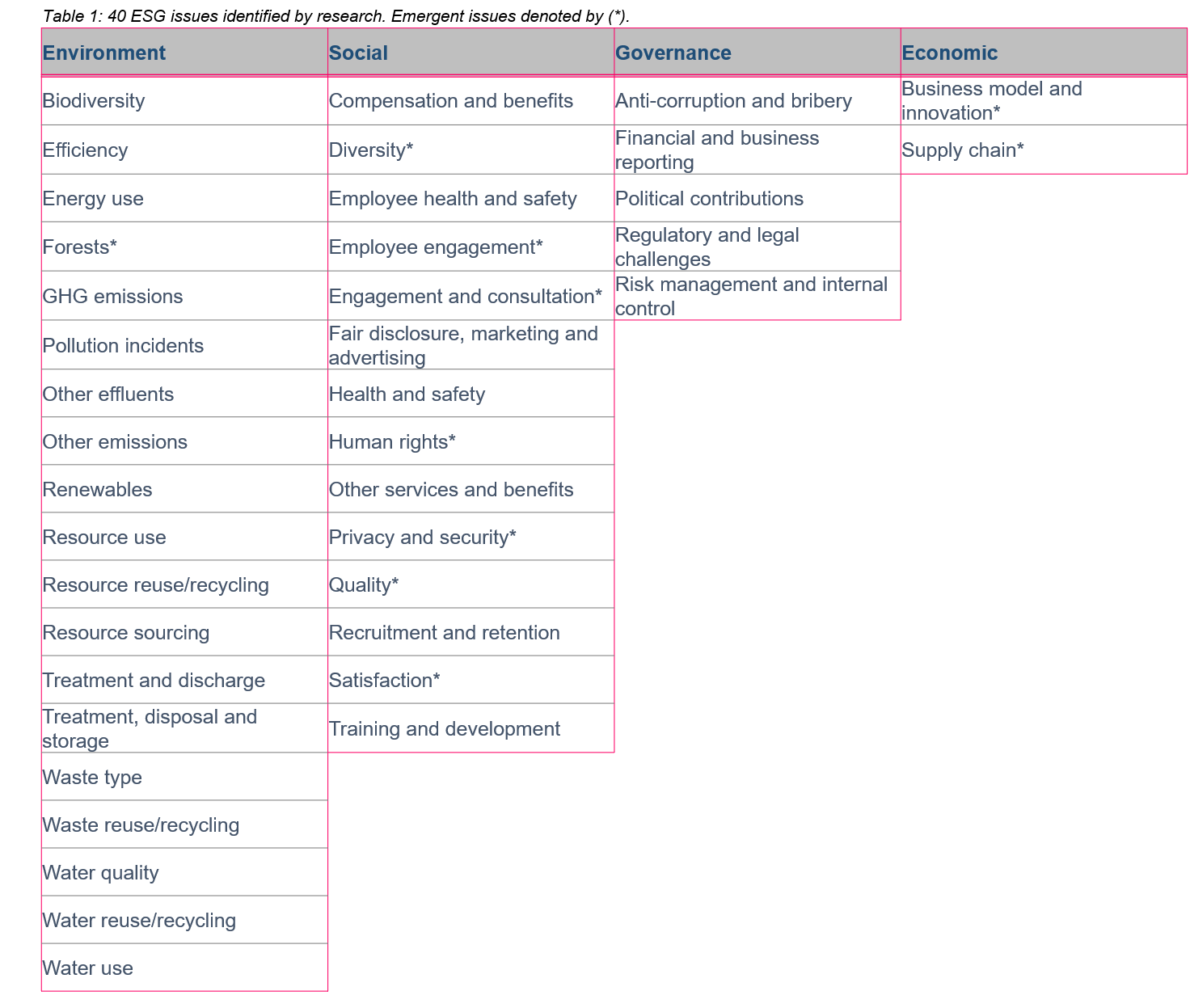

CDSB and WBCSD were able to identify 30 ESG issues that showed broad consensus between regulators, standard setters and companies (see Table 1). These 30 issues, 60% of which were environmental in nature, provide regulators and standard setters with a basis on which prioritise their alignment efforts, whether individually or collaboratively.

In addition to these 30 ESG issues, the research identified a further 10 issues that were commonly reported by companies as material to their business but were less well represented by the reporting provisions of regulators and standard setters (see Table 1). These issues, which are predominantly socially oriented, are understood as emergent and not yet well covered by the most important reporting requirements and frameworks. As such, these are 10 issues for regulators and standard setters to especially consider when revising or developing new reporting provisions for the market.

Finally, we compared these 40 ESG issues with those issues highlighted by several key investor organisations – EFFAS, CFA Institute, FTSE Russell and MSCI – as important in understanding corporate sustainability. An agreement of over 75% was found between the 40 ESG issues and those pinpointed by the investor organisations, results which offers further confidence to the research findings.

In total, these 40 ESG issues offer reporting regulators and standard setters with a means of focusing the collaborative efforts needed to ensure a reporting landscape that is representative and effective for companies, investors and wider society alike. Important technical areas for regulators and standard setters include consistency in metrics and methodologies, scope of applicability and channel of disclosure.

So, what can companies do to enhance their disclosure in line with these ESG issues? First, we recommend that they place relevance and materiality at the centre of their disclosure processes. By doing so, companies will be able to declutter their reporting and home in on the ESG issues that matter most, offering them the time necessary to report the decision-useful information that the capital markets seek. It can’t be emphasised enough that ESG reporting is not a tick-box exercise, but one which should be central to how a company understands its business and communicates its strategy.

Second, companies need to ensure that they are completing disclosure requests and using reporting framework and standards in an effective manner that suits their needs. There is much overlap and commonality between the various reporting provisions that companies contend with on an annual basis. By better understanding these provisions and the details of the disclosure requests, companies can streamline their reporting processes to ensure the effective reuse of data and information. As well as easing the burden of disclosure, it would better certify consistency and comparability across reporting. This may seem like a daunting exercise, especially given the pressures of the reporting cycle. In the long run, though, it will benefit report preparers and users greatly.

Third and finally, we encourage companies to fully make use of the resources that have been developed to untangle the complexity of reporting. For example, the Reporting Exchange and Indicator Library platforms both effectively map and organise key components of the reporting landscape for companies. Further, there are already many helpful guides designed to assist companies in navigating complex areas of corporate reporting, such as the Corporate Reporting Dialogue’s report on the alignment that exists between the key frameworks and standards for climate-related disclosures and the ESG Disclosure Handbook is designed to help companies take back control and manage their reporting processes strategically.

You can read the full findings of the research in WBCSD’s Reporting matters, which is available here.

Written by David Astley, Senior Technical Officer, CDSB

Email: