New guidance underway for companies to address biodiversity and land use-related financial reporting. CDSB's Technical Director, Ravi Abeywardana, shares insight into the work.

It is increasingly recognised that biodiversity plays a vital underpinning role in supporting human life. In turn, threats to biodiversity have the potential to cause significant and wide-ranging impacts for business. This is starkly evident in the IPBES most recent global assessment report, which identified that biodiversity is declining faster than at any time in human history.

CDSB’s recent research on European reporting practices shows a definitive gap in the integration of biodiversity matters into mainstream reports, with less than half of Europe’s largest companies including reference to the topic in their reports. Consultation with stakeholders and experts also tells us that it is not only consolidation that is needed, but an evolution of reporting for biodiversity matters.

In the face of the urgent need to address biodiversity loss, it is imperative that businesses seek to understand, report upon and mitigate their impacts on the natural world. Additionally, they should assess and disclose the material financial-related risks and opportunities these matters pose to their businesses . This is an important contributor to ‘pricing in’ the externality of biodiversity impacts to financial markets, as was recommended in the landmark Dasgupta Review on the Economics of Biodiversity.

CDSB Framework: history

CDSB’s Framework has evolved over time, with the first CDSB Framework, the Climate Change Reporting Framework, released in 2010, focused on the risks and opportunities that climate change presents to an organisation’s strategy, financial performance, and condition. In 2013 CDSB’s Board agreed following a request from the European Union capital market policy officials to expand the scope of the Framework beyond climate change to encompass environmental information and natural capital, with this revision published in 2015.

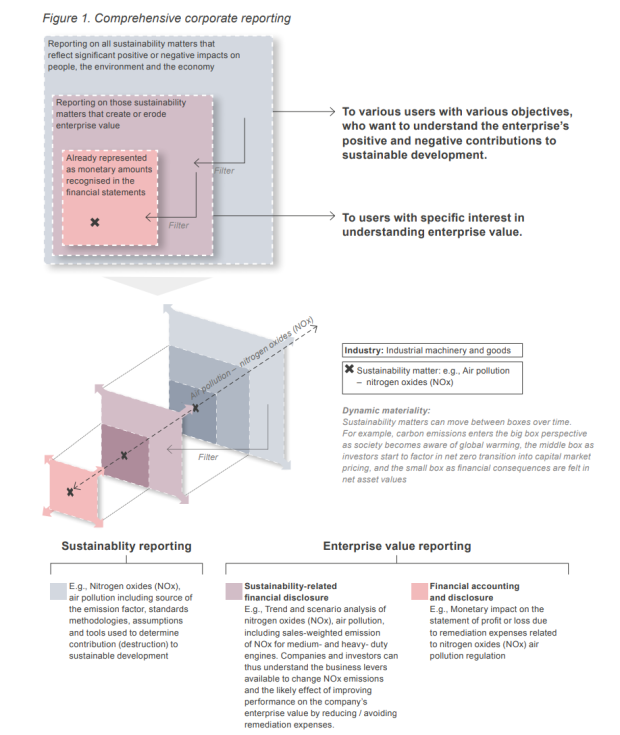

The CDSB Framework is focused on reporting financially material environmental topics, that influence enterprise value, in mainstream reports to investors – this built directly on the International Accounting Standard Board’s (IASB’s) Conceptual Framework, applying financial reporting principles. However, we at CDSB know that the materiality of corporate sustainability issues is dynamic, meaning that the concerns of one stakeholder group may quickly become material for financial decision-makers (see figure below). As such, representation from organisations such as CDP, the Capitals Coalition and the UN WCMC in our working group, which is Chaired by the excellent Scarlett Benson from SYSTEMIQ, is important to ensure reciprocity and responsiveness in the reporting landscape (see below section ‘Working collaboratively to advance disclosure globally.’)

The framework is built on existing market practice, and allows for the flexible application to wider environmental, social and governance (ESG) topics. The Task Force on Climate-Related Financial Disclosures (TCFD) recommendations are at the foundation of CDSB’s framework.

Advancing disclosure of nature-related financial information

With this context, and as part of a four-year programme of work to develop application guidance on the CDSB’s Framework focused on nature-related financial disclosures, a program developed in 2018 and commenced in June 2019, the application guidance helps users of the CDSB Framework apply natural capital elements of climate change, water and land use and biodiversity. The CDSB Framework is aligned to, but also underpinned, the 2017 Task Force on Climate-Related Financial Disclosure (TCFD) recommendations.

As the last phase in this work programme, CDSB has established a land use and biodiversity working group to support the development of TCFD-aligned guidance for companies on the integration of material land use and biodiversity-related matters into their mainstream corporate reporting. The working group comprises of close to 40 global experts drawn from corporates, investors, academia, governments and NGOs and will bring their expertise to ensure the CDSB guidance builds effectively on existing practices and resources to provide practice advice for companies.

Working collaboratively to advance disclosure globally

Whilst CDSB is a well-established voice on nature-relate financial disclosure, it must be acknowledged that a wide range of initiatives have and continue to develop, aimed at supporting and advancing this topic. Most notably, the intention to establish a Task Force on Nature-Related Financial Disclosures (TNFD) was announced in 2020, with this initiative currently working towards the establishment of a formal task force later this year. It is vital that efforts to advance disclosure are pursued collaboratively, to ensure these do not create further confusion for companies and contribute towards the goal of a global, harmonised reporting landscape.

In developing the land use and biodiversity application guidance, CDSB wishes to build on what is already offered to companies, taking forward existing reporting practices for material biodiversity issues whilst seeking to address the challenges outlined above. The guidance will be complementary to existing reporting frameworks, standards and guidance.

IFRS Sustainability Standards Board

The ambition of CDSB is to develop practical application guidance of its Framework on biodiversity to help companies address these challenges in the immediate term, but also to provide a solid basis for IFRS Sustainability Standards Board (SSB) to build upon the climate prototype to address other environmental and social issues, that affect enterprise value. Over the medium and longer term, it is envisaged that this guidance would contribute to the work of the Sustainability Standards Board (SSB) due to be established by the IFRS Foundation. It is also hoped that the TNFD can also build upon it.

Next steps for the guidance

The guidance will be developed with the input of the land use and biodiversity working group over the next few months, and is expected to be released for public consultation in Q3 2021. CDSB will then be working to test and rollout out the guidance with companies and other stakeholders, equipping them with the tools and knowledge required to integrate biodiversity and land use issues into their reporting at pace over their upcoming reporting cycles.

Most importantly for companies, we would encourage you to get started now in assessing and reporting upon the financially-material implications of biodiversity and land-use related topics for your organisation. Whilst it is acknowledged that challenges exist and preliminary disclosures may require further iteration, what is most important is to make a start and take action!

CDSB’s intention is to support companies on this journey through our work on biodiversity and land use.

How you can get involved

Please reach out to me directly at ravi.abeywardana@cdsb.net and (Technical Manager) if you would like to learn more about CDSB’s work on land use and biodiversity.

See also:

- Briefing on biodiversity, deforestation and forest degradation disclosure in the EU

- Land use and biodiversity-related disclosures

- Land Use and Biodiversity Working Group

|

With the contribution of the LIFE Programme of the European UnionThe content of this page is the sole responsibility of the author and can under no circumstances be regarded as reflecting the position of the European Union |

| This publication is funded in part by the Gordon and Betty Moore Foundation. | |

|

This publication is funded in part by UK PACT. |