Businesses across the globe are about to make “climate disclosure” and “climate risk” this year’s buzzwords.

What do you imagine when you hear the phrase “business taking climate action”? In most cases, it is likely that you will still be picturing a company looking for a PR opportunity or one isolated visionary leader who can’t get traction outside their own company.

If this is the case, keep an eye out for these words this year, because businesses across the globe are about to make “climate disclosure” and “climate risk” this year’s buzzwords.

Last month, the governor of the Bank of England, Mark Carney, and the former New York mayor Michael Bloomberg made headlines with the launch of a report that will put in the spotlight the way global financial markets deal with climate change.

In short, the Task Force Recommendations report encourages all financial organizations, ranging from banks, insurance companies, to asset managers and asset owners, and companies with public debt or equity, to disclose in a transparent and consistent way their financial risks and opportunities associated with climate change.

The report is the result of one year of work by the Task Force on climate-related financial disclosures, a business and investors-led initiative, launched at the COP21 climate negotiations in Paris, and convened by the Financial Stability Board.

The aim of the initiative is to drive the adoption of the recommendations across the G20 countries, as the final version of the report will be released in July and presented to the G20 leaders gathering in Hamburg. Having the support of the governments of the largest economies in the world would be the ultimate step to make climate disclosure the new norm.

The Recommendations

The work of the Task Force culminated in the publication of three documents: the Recommendations report, the Annex containing guidance on the recommendations and the technical supplement, which focuses on scenario analysis. It must be noted that all these documents are not in their final version: the Task Force has opened a two-month consultation process, which allows everyone to send feedback and comments by February 2017 before the official launch of the final documents in July.

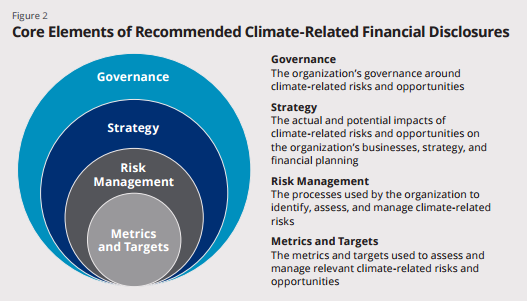

The Recommendations report – which is the main document – outlines four thematic areas of disclosure related to climate change, as showed in the image below: governance, strategy, risk management, metrics and targets.

Image: Recommendations of the Task Force on Climate-related Financial Disclosures

These four thematic areas are then accompanied by:

- Eleven recommended supporting disclosures;

- Guidance for all sectors, which defines what sort of information companies should report;

- Supplemental guidance for specific non-financial and financial sectors, which elaborates further on some targeted sectors;

- Illustrative metrics for non-financial sectors.

Climate risk and opportunities

Companies have been reporting the economic risks they face for decades and they often have a statutory responsibility to do so. Generally, the economic risks include the possible negative outcomes that may affect different “risk targets”, including the capital resources, net sales, revenues, income from continuing operations and future financial conditions among others. Climate change is predicted to have possible negative outcomes that could affect any or all of these risk targets.

The Task Force stresses that there are both physical risks associated with climate change – those related to extreme weather events and changes in weather patterns – and risks associated with the transition to a low-carbon world.

The latter include business risks such as new regulations on greenhouse gas emissions, upfront costs of transitioning to lower emissions technology, uncertainty in market signals and changing consumer preferences. A series of issues that companies will not be able to ignore any longer.

The flip side is that tackling climate change and transitioning to a clean economy also opens numerous business opportunities. The Task Force identifies five main categories of economic opportunities, including a more efficient production and use of resources, access to new markets, the development of new technologies and access to low-emission energy sources.

Access climate change and financial information in one place: mainstream reports

Companies have a clear and well-defined channel to disclose publicly their financial information: through their mainstream corporate report, an annual document which includes financial statement and helps investors and stakeholders access the information they need about the company's activity and financial performance.

But as climate change and environmental matters are classified as "non-financial" information, they are often relegated to sustainability reports, websites or even not reported on at all.

By recommending that companies include climate information in their mainstream reports, the Task Force acknowledges that climate change is a material business risk. Investors should be able to access climate-related information in a comparable and timely way, and should be able to use it to make informed decisions to shift their capital to create more sustainable and fair markets.

The time to act is now

Meeting the goals of the recommendations will be a big task and will require a great deal of work for some companies. However, there is lots of help and guidance available in the Task Force’s documents and from other organizations.

The Task Force has been able to deliver their recommendations in such a short window of time because it built on what many other organizations have been doing for decades as evidenced in the cross-referencing to existing reporting regimes, which have been paving the way for a rapid scaling up of climate disclosure at a global level.

Last year proved that after the adoption of the Paris Agreement, the big unanswered question to solving the climate challenge concerns climate finance. Financial markets need to understand, measure and report their exposure to climate change, or they will have to cope with a global crisis that has still too many unpredictable aspects.

Many criticized politicians and others for their apparent failure to see the financial crisis of 2008 coming.The Financial Stability Board is doing everything possible to make sure that they are not caught out by the potential financial effects of a climate crisis.

This article first appeared on the World Economic Forum Agenda