Climate-related risk has never been more prominent in corporate discourse, cemented by today’s release of the Task Force on Climate-related Financial Disclosures (TCFD) second Status Report.

Climate-related risk has never been more prominent in corporate discourse, cemented by today’s release of the Task Force on Climate-related Financial Disclosures (TCFD) second Status Report. The 2019 report analyses disclosure practices aligned with the TCFD recommendations between 2016 and 2018, the decision-usefulness of existing climate-related financial disclosures and offers information to support preparers in implementing the recommendations.

My team in the CDSB Secretariat engage on average with over 100 companies a week on TCFD implementation. What we are hearing first-hand across the world coincides with the key themes and findings outlined in the report:

- growing momentum and understanding of climate-related information by companies and investors;

- disclosure of climate related financial information has increased but is still not sufficient scale and quality for investors;

- there are challenges understanding scenarios and disclosing strategy resilience;

- more clarity is needed on the potential financial impacts of climate-related issues on companies; and

- engaging of multiple functions across the business takes time and requires education.

Is the hype making an impact?

The report confirms that 785 organisations have expressed their support for the TCFD recommendations, a more than 50% increase from the publication of the first status report in September 2018. The “financial” sector is leading the way with 374 supporting firms responsible for $118 trillion of assets, followed by the “non-financial” sector at 297 and finally “other”, such as governments and business associations, at 114.

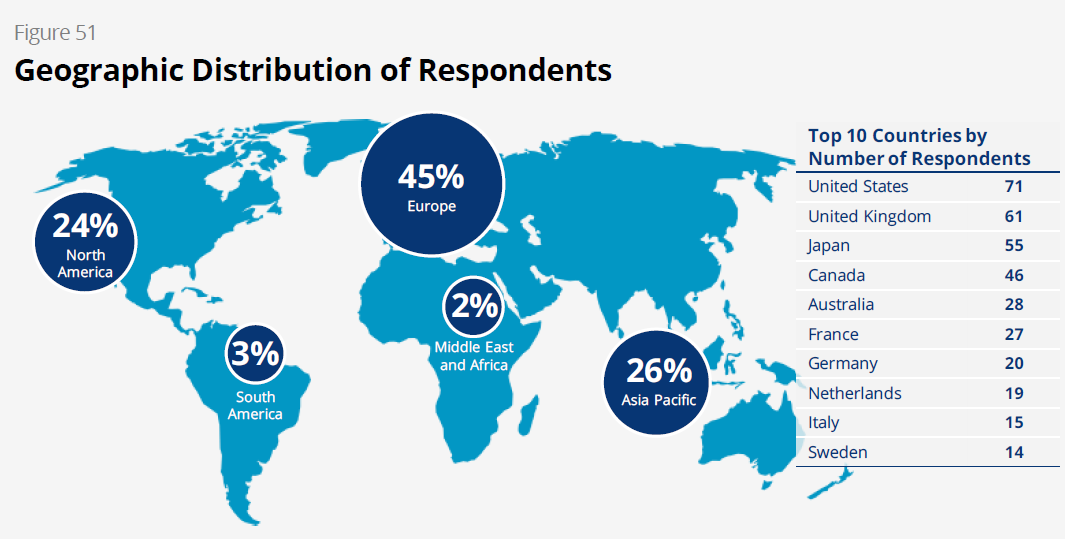

Figure 51 in the report illustrates the geographic distribution of respondents.

Source: TCFD 2019 Status Report

Artificial intelligence technology was used to review reports from 1,126 companies in 142 countries. The results indicate that while the average number of recommended disclosures implemented per company has increased by 29% from 2.8 in 2016 to 3.6 in 2018, “more progress is needed”. Only around 25% of companies disclosed information aligned with more than five of the 11 recommended disclosures and only 4% of companies disclosed information aligned with at least 10 of the recommended disclosures.

Now let’s put these numbers into perspective.

The members of the World Federation of Exchanges currently list 48,000 companies, so while we are making strides in the right direction, there is still a long way to go with enormous financial risk at stake. The report notes that, according to the United Nations, delays in tackling climate change could cost companies nearly $1.2 trillion over the next 15 years.

Just yesterday CDP’s Global Climate Analysis report warned that 215 of the biggest global companies report almost US$1 trillion at risk from climate impacts, with many likely to hit within the next 5 years.

In his opening letter, Michael Bloomberg, Chair of the Taskforce, acknowledges the need for accelerating the adoption of climate-related financial disclosures saying “…, progress must be accelerated. Today’s disclosures remain far from the scale the markets need to channel investment to sustainable and resilient solutions, opportunities, and business models. I believe in the power of transparency to spur action on climate change through market forces”.

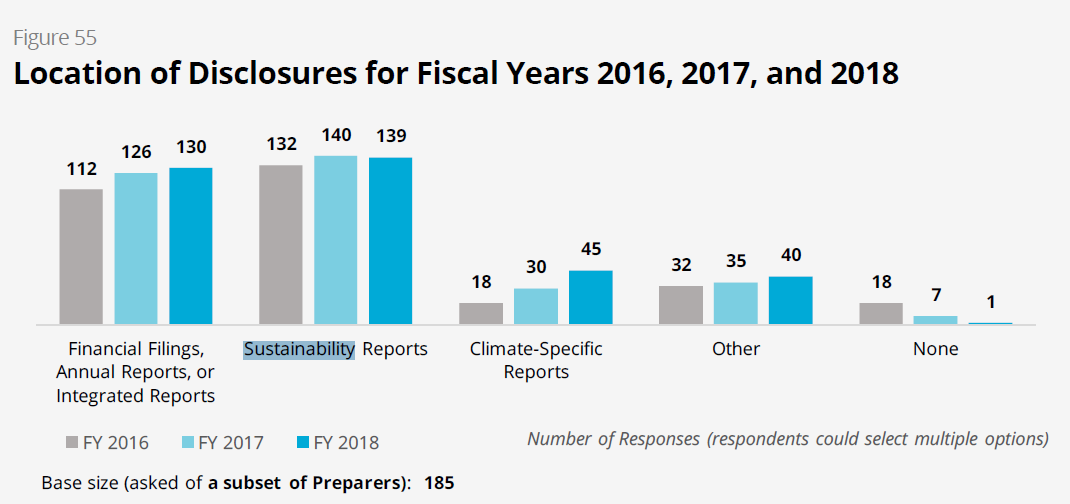

If the TCFD is to provide greater transparency and clarity on the potential impacts of climate-related issues on companies, disclosures need to urgently move into the mainstream report and not principally included in separate climate risk report or sustainability report.

Figure 55 in the report illustrates the location of disclosures.

Source: TCFD 2019 Status Report

By including disclosures in the mainstream report, climate-related information can be better connected to financial information. This will help achieve the intended outcome of providing decision-useful information to enable the investment community to make better informed decisions on where and how they want to allocate their capital.

Last year our First Steps report investigated the annual reports and climate-related financial disclosure practices of 30 companies (from our sample of 80) of the largest companies by market capitalisation in Europe. We are currently revisiting the progress these companies have made in year two and look forward to sharing our findings this Autumn and offering real world examples of what good practice looks like in the mainstream report.

Available resources to support transparency and implementation

There is a wide range of resources available to help companies either take the first step or improve the depth and quality of their climate-related financial disclosures. Most recently CDSB and the Sustainability Accounting Standards Board (SASB) released the TCFD implementation Guide with mock disclosures in response to market demand for examples of what good practice could look like.

The release of the Guide elevates the work of the Corporate Reporting Dialogue Better Alignment Project. The first year of the project will see participants (CDP, CDSB, GRI, IIRC and SASB) align their frameworks against the TCFD recommendations, which could have significant impact on uptake and implementation worldwide.

Additionally, the TCFD Knowledge Hub houses guidance, case studies, tools and webinars to facilitate implementation of the TCFD recommendations, while PRI has developed climate-related scenario tools and resources to support asset managers and asset owners.

Redefining business as usual

For someone who has been part of the non-financial reporting agenda for 10 years, the report signals positive steps in the right direction and I welcome Michael Bloomberg’s opening call to action for greater transparency in capital markets. But the sobering reality is that the UN’s Intergovernmental Panel on Climate Change tells us we have less than 11 years to keep warming below 1.5 degrees and the percentage of companies disclosing climate-related information has increased, but overall is low.

In the absence of major coordinated action, global temperature is on track for a 3 – 5 degree rise by the end of this century. Even if we stopped emitting greenhouse gases today, global warming would continue for at least several more decades, increasing the quantity and magnitude of risks to business and our financial systems globally. Now is the time we move beyond the hype and turn the conversation on climate change into concerted action with a global response that is proportionate to the scale of the challenge.

CDSB is hosting a webinar on 17 July at 12pm BST where we’ll review the main findings of the 2019 TCFD Status Report and what it means for corporate reporting moving forward. Register online now.