What, Why & How?

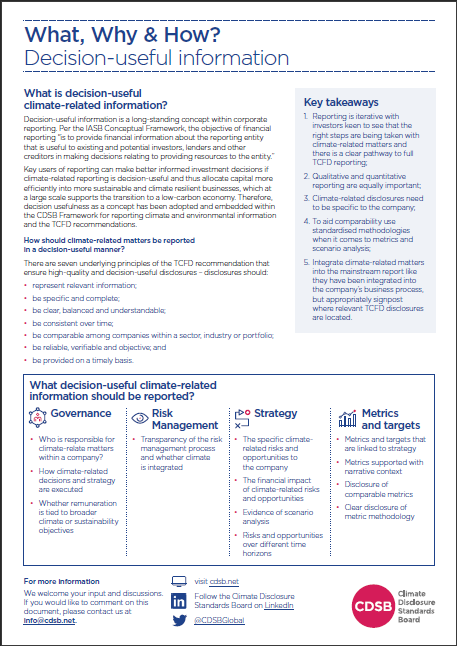

This paper seeks to highlight the specific climate-related information, in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, that investors consider to be useful when it comes to their own decision-making process. This in turn should guide preparers in the areas that should be focussed and the existing resources available to support them.

Key takeways

- Reporting is iterative with investors keen to see that the right steps are being taken with climate-related matters and there is a clear pathway to full TCFD reporting;

- Qualitative and quantitative reporting are equally important;

- Climate-related disclosures need to be specific to the company;

- To aid comparability use standardised methodologies when it comes to metrics and scenario analysis;

- Integrate climate-related matters into the mainstream report like they have been integrated into the company’s business process, but appropriately signpost where relevant TCFD disclosures are located.

Download the paper

|

Download the key takeaways

|

|

|