Extreme weather, failure of climate-change mitigation and adaptation, as well as natural disasters ranked as top 3 most severe risks in the WEF annual report.

Each year the World Economic Forum (WEF) publishes its Global Risk Report to identify and analyse the greatest risks and issues facing the world. The 2019 report is based on the findings from the Global Risks Perception Survey (GRPS), which is completed by around 1,000 global experts and decision-makers.

For the third year in a row environment-related risks represent the greatest threat, ranking in the top three out of five in terms of likelihood and fourth by impact.

Extreme weather events were rated as the most likely risk to occur over the next 10 years. This was closely followed by failure of climate change mitigation and adaptation for both risk and impact, a trend which the authors note could be attributed to the growing concern from survey respondents about environmental policy failure “having fallen in the rankings after Paris.”

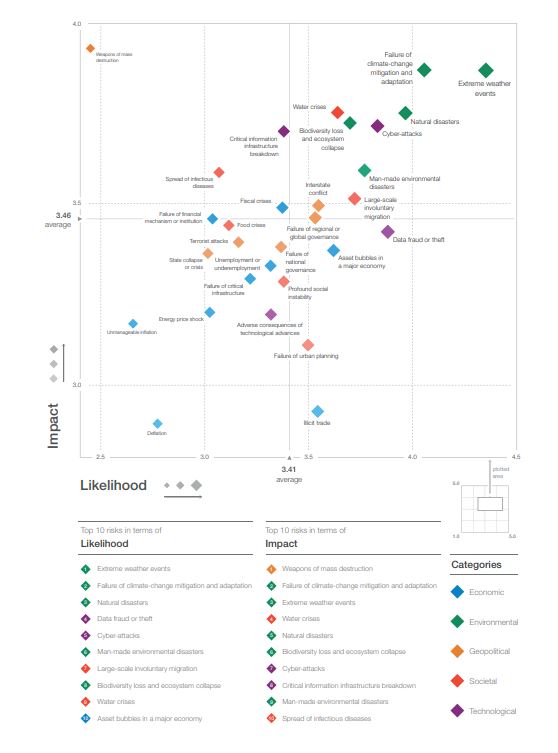

Global Risks Landscape 2019:

Edging closer to a global climate crisis

The report highlights that ”of all risks, it is in relation to the environment that the world is most clearly sleepwalking into catastrophe.”

While the accelerating pace of biodiversity loss and ecosystem collapse were important concerns, the report also warns of the threats that climate-related risks pose to the global value chain. Disruptions to the production and delivery of goods and services due to environmental disasters are up by 29% over the last 7 years. North America was flagged as the region worst-affected, mainly caused by hurricanes and wildfires. The example that the report offers focuses on the US automotive industry, where only factory fires and company mergers caused more supply-chain disruptions than hurricanes.

Mitigating risk through non-financial reporting

The rankings shouldn’t come as a surprise. 2018 experienced the fourth warmest year on record and the IPCC issued a stark warning on the consequences of an increase of 2°C of global warming.

As Governments and regions seek to reduce emissions and minimise impact and vulnerability to the global risks highlighted in the report, financial markets will play a critical role in implementing and financing the low-carbon transition. Information lies at the heart of facilitating a sustainable, long-term solution to managing environmental risk and climate change. Last year, the Economist declared that “The world’s most valuable resource is no longer oil, but data.”

By disclosing climate change and environmental information companies can gain greater insight into the financial implications of climate change on their operations, performance and overall strategy. Furthermore, investors will be better equipped with the necessary tools to make informed capital allocations that facilitate the transition to a low carbon economy.

Last year marked the first year of reporting under the EU Non-Financial Reporting (NFR) Directive, which requires large companies to disclose certain information on the way they operate and manage social and environmental challenges. Research by CDSB and CDP shows that only 44% of the largest European companies explain in their management reports how their business models are affected by climate change or environmental challenges.

Where such reporting was mandatory before the NFR Directive, like the UK and France, companies seem to perform better.

While we have seen progress in the non-financial reporting landscape, in particular with The Task Force on Climate-related Financial Disclosures (TCFD), there is vast room for improvement with the implementation of these developments. In the long-run, mandatory disclosure of climate-related risks within mainstream reports will lead to improved resiliency and support more sustainable economic, social and environmental systems. The WEF report highlights the risks, and we must remember that there are immense benefits and opportunities to taking action on climate change now,

Even if the policies aren’t in place, there are multiple voluntary frameworks and standards that enable companies to identify and disclose climate risks and opportunities. Over 500 companies have now indicated their support for TCFD recommendations. We look forward to working with more companies in 2019 and beyond to combat climate change.

Download the CDSB Framework to begin integrating climate and environmental information into your mainstream reporting practices.